td ameritrade tax rate

Unsupported Chrome browser alert. TD Ameritrade doesnt charge any commissions for purchases of US.

For current 7-day yields on the funds below you can leave the TD.

. And foreign corporations capital gains distributions mutual fund dividends federal and foreign tax withheld and non-taxable distributions. TD Ameritrades internal financial advisor firm is TD Private Client Wealth which has just under 56 billion in assets under management AUM and a fee-based fee schedule. Options trading subject to TD.

This TEY calculator is intended to be used. So if you own two CDs from different. 3 The taxable portion of distributions and withdrawals are generally subject to ordinary income tax rates and if taken before age 59½ may be subject to a 10 federal tax penalty.

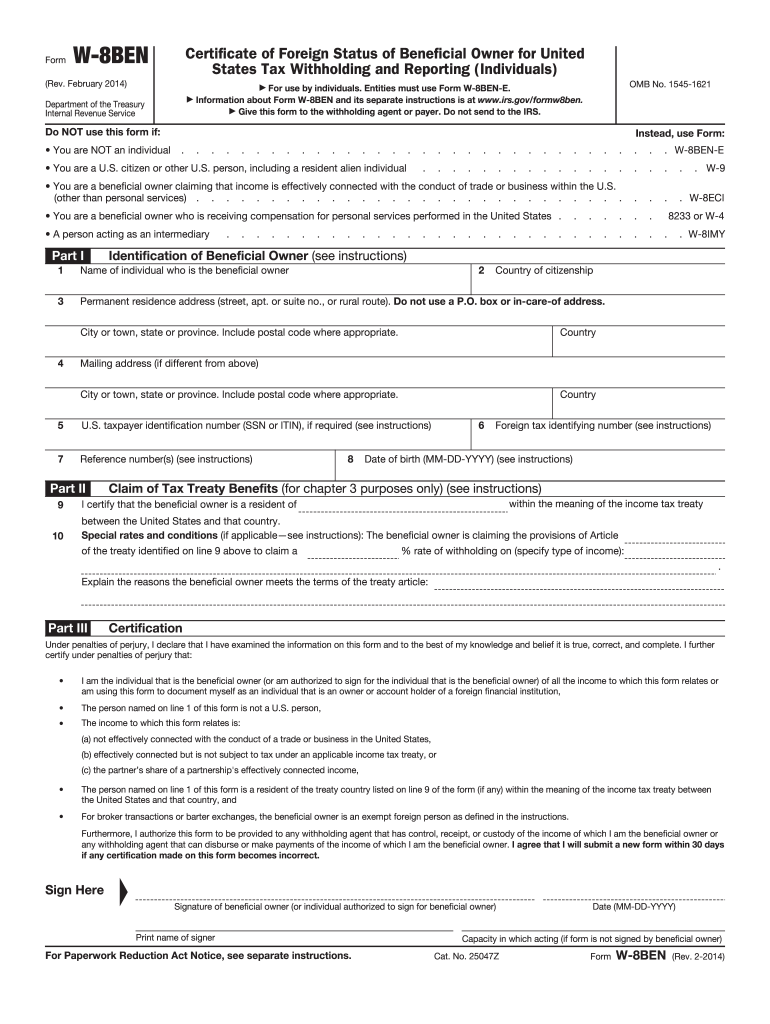

Your taxable equivalent yield is Click the Calculate Button. TD Ameritrade charges 1 per bond for secondary transactions placed online. Hi I live abroad and I recently wire transfered 1000 from an international bank account to my TD ameritrade account.

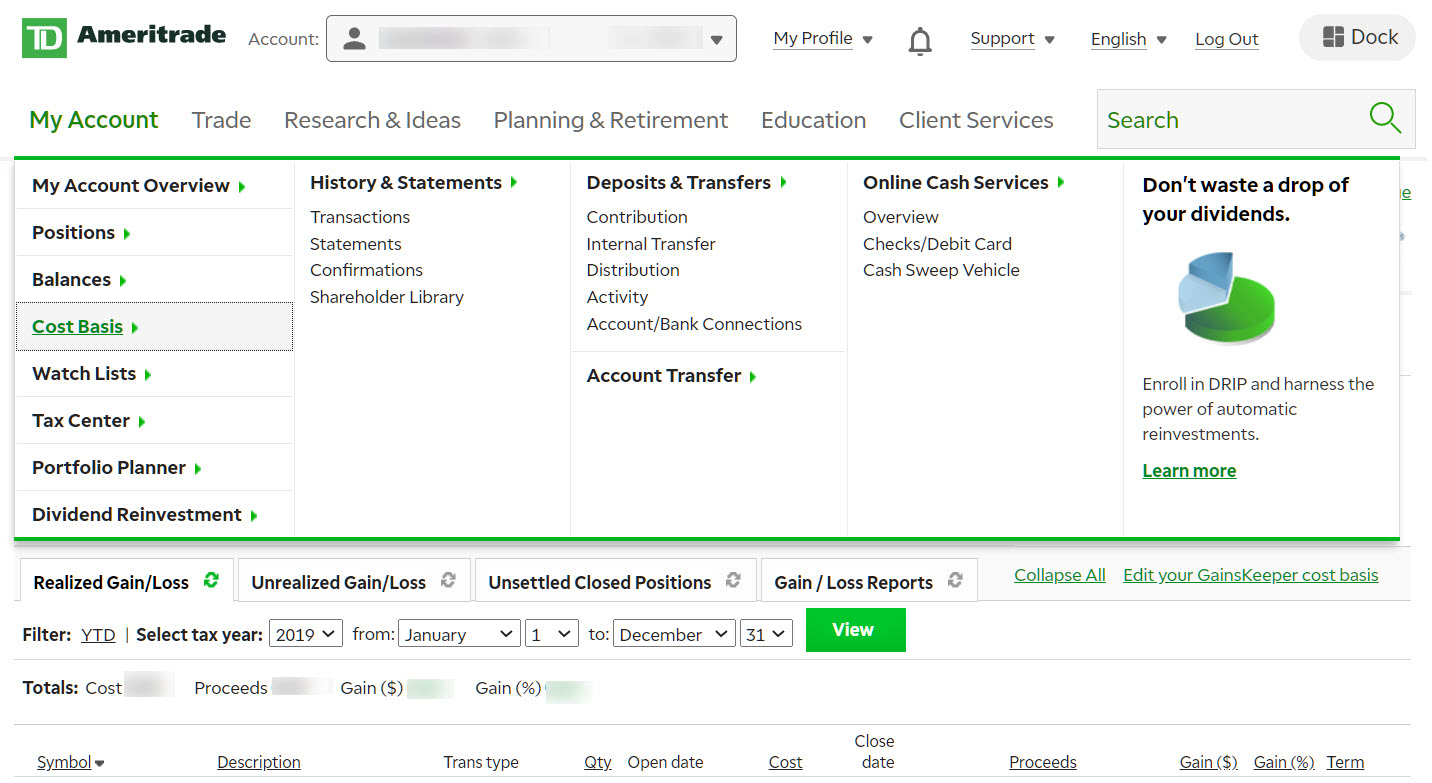

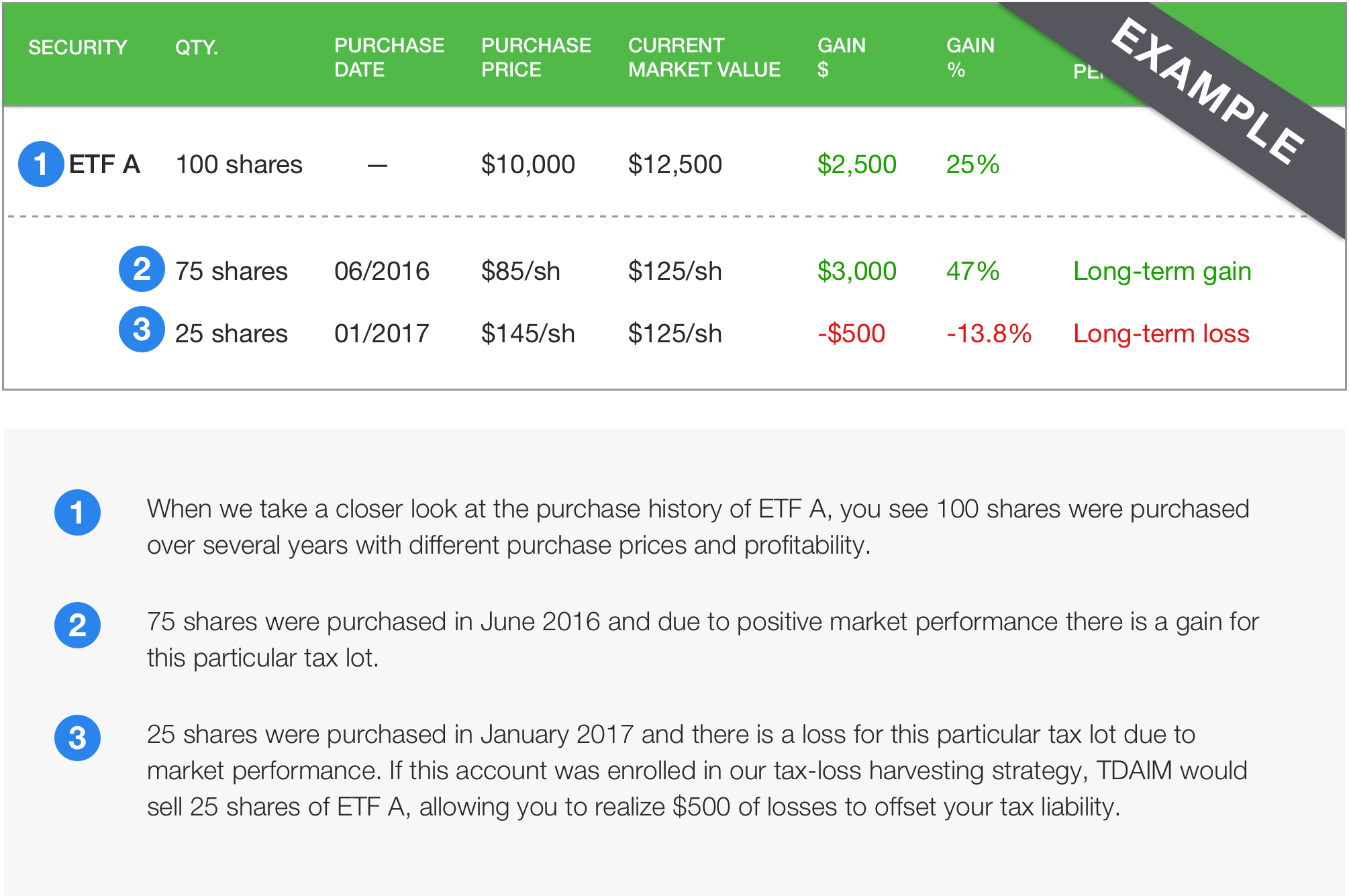

See all contact numbers. With the exception of the 10 and 35 brackets the current tax rates. A tax lot is a record of a transaction and its.

This markup or markdown will be included in the price quoted to. Addressing common client concerns. 2021 Tax reset.

That is withheld by TD Ameritrade Singapore and sent to the US. This is a secure page TD Ameritrade. Every CD is FDIC-insured up to 250000 per depositor per issuer.

Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security. Ordinary dividends of 10 or more from US. With a TD Ameritrade account you have access to a wide variety of brokered CDs.

For many of your clients 2020 was probably the most confusing year in recent memory when it came to filing their. The statutory rate is. TEY is only one of many factors that should be considered when purchasing a security.

International Wire Transfer Tax Rate. The fees are charged to companies that allow their clients to hold ADRs such as TD Ameritrade and then those fees are passed through to the client that owns the ADR. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the marketplace.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. However I only received 978 in my. Internal Revenue Service IRS on your behalf so no additional tax is due after the year ends.

The marginal tax rates in 2017 before the tax reform were 10 15 25 28 33 35 and 396. All of the funds listed below are no-load funds with no transaction fee and no short-term redemption fees. The marginal tax rates in 2017 before the tax reform were 10 15 25 28 33 35 and 396.

When acting as principal TD Ameritrade will add a markup to any purchase and subtract a markdown from every sale. TD Ameritrade does not provide tax advice and cannot guarantee accuracy of state tax withholding information as state laws are subject to change and interpretation. With the exception of the 10 and 35 brackets the current tax rates.

When setting the base rate TD Ameritrade considers indicators including but not limited to commercially recognized interest rates industry conditions relating to the extension.

Td Ameritrade Essential Portfolios 2022 Review The Ascent By Motley Fool

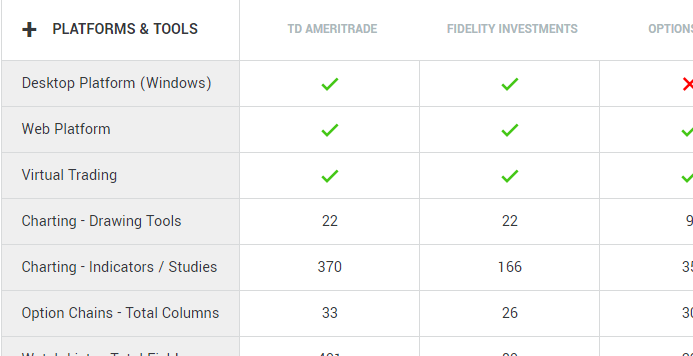

Td Ameritrade Broker Review 2021 Warrior Trading

Here S How To Minimize Taxes When Investing Youtube

Ria Industry Advocacy Td Ameritrade Institutional

Investment Account Types Td Ameritrade

Td Ameritrade Review A Leading Online Stock Broker

Schwab And Td Ameritrade To Take Big Revenue Cuts After Dropping Commissions Financial Planning

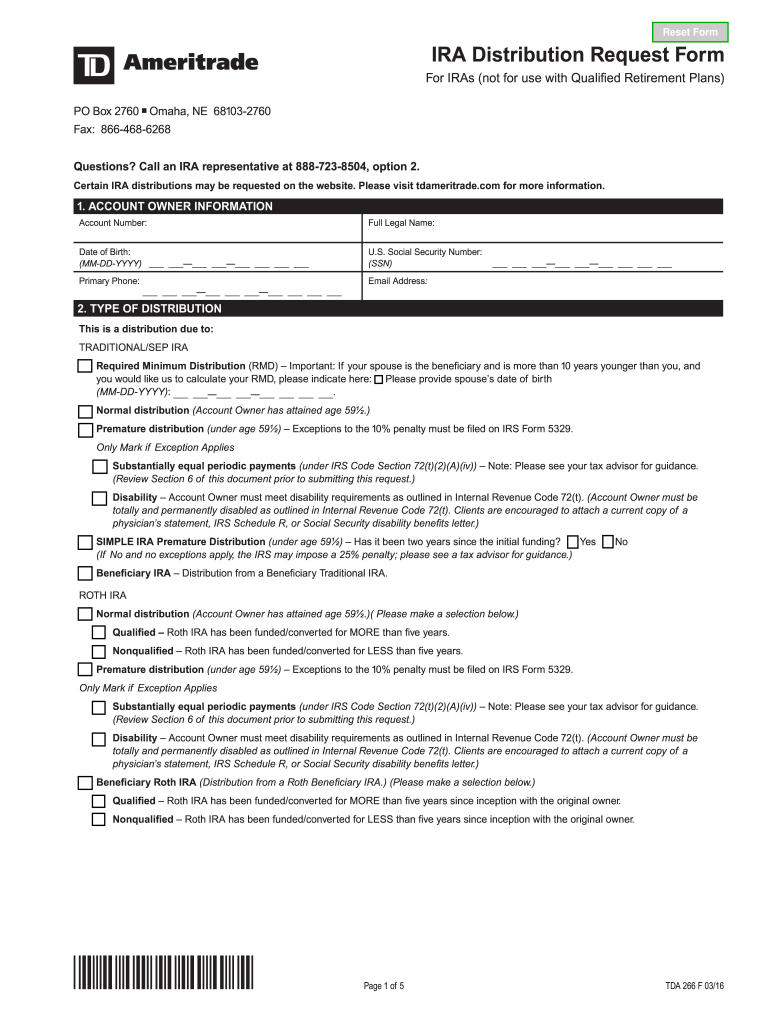

Td Ameritrade Form Tda266 Fill Out Sign Online Dochub

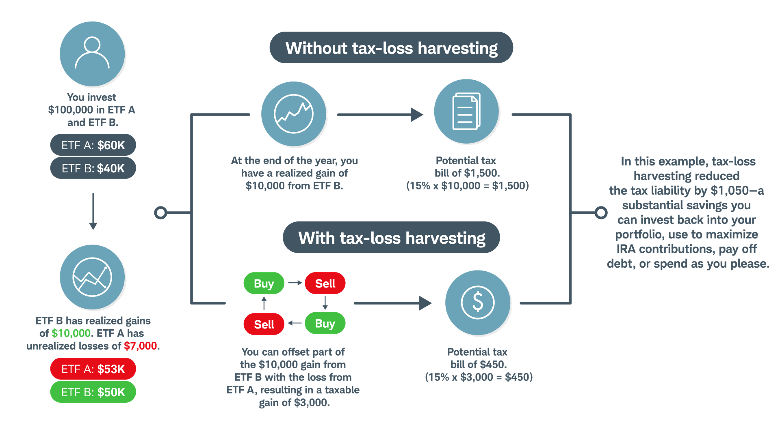

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

Td Ameritrade Promotions 2500 1500 1000 600 Cash Bonuses

How Do You Renegotiate Your Commission Rate On Td Fishbowl

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Td Ameritrade W 8ben Instructions Fill Out Sign Online Dochub

Tax Bite Capital Gains Short Term And Long Term Inv Ticker Tape

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade